[Guide] Accessing Fidelity NetBenefits & Employee Benefits Everything You Need To Know

In an increasingly complex financial landscape, how can you ensure your financial well-being, especially when navigating the world of employee benefits and investments? Understanding and actively managing your benefits, coupled with strategic investment choices, is not just beneficial; it is essential for long-term financial security.

The digital age has brought unprecedented access to information, yet it has also created a need for greater discernment. This holds particularly true when it comes to employee benefits and the myriad of options available, from retirement plans to healthcare and stock options. Being informed is the first step toward leveraging these resources effectively. For those whose employers partner with financial institutions like Fidelity, this translates into access to a range of services, including managing 401(k)s, healthcare benefits, and stock plans, all accessible through a dedicated online portal like Fidelity NetBenefits.

For this article's purpose, let's use "Fidelity NetBenefits" to illustrate how employees can manage their benefits and how such platforms work:

| Category | Details |

|---|---|

| Platform Name | Fidelity NetBenefits |

| Primary Function | Online platform to manage workplace benefits and investments. |

| Services Offered |

|

| Employer Partnerships | Works with various employers to offer benefits management services. |

| Address | Fidelity Investments Institutional Services Company, Inc., 82 Devonshire Street, Boston, MA 02109 |

| Key Features |

|

| Official Website | Fidelity Investments Official Website |

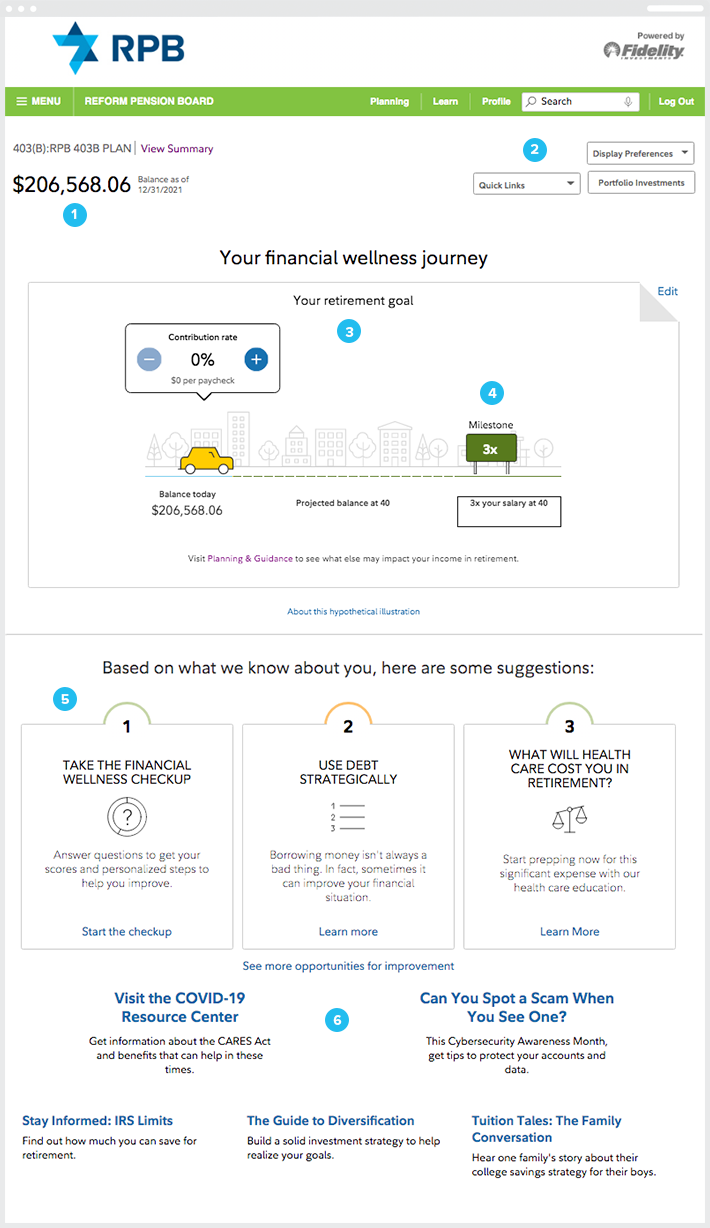

Fidelity NetBenefits is more than just a portal; it's a comprehensive ecosystem for managing your financial well-being, offering tools to understand your financial situation better and make informed decisions. It's like having a financial advisor at your fingertips, accessible anytime, anywhere. From the simplest task of viewing account balances and summary information, to more complex actions such as filing a claim or signing up for direct deposit, the platform offers a wide range of functionalities.

Consider the role of cookies in providing a seamless user experience. "These cookies are necessary for the website to function and cannot be switched off in our systems," they state, ensuring that the basic functions of the website operate correctly. They are usually triggered by your specific actions, such as setting privacy preferences or logging in. This is a crucial aspect for securing your data and providing a smooth navigation experience. The cookies also collect information about the website's performance by counting visits and traffic sources. This way, website owners can measure and improve the performance of the website.

As an employee, it's crucial to understand the nuances of your benefits package. Whether it's the 401(k) offered through Fidelity or health benefits provided by Lukes University Health Network, a solid understanding ensures that you are using these resources to their full potential. Lukes University Health Network, recognizing the importance of employee health, offers healthy living resources to support its workforce, highlighting the shift towards employee wellness programs.

For seamless access, Fidelity NetBenefits provides a single point of entry to manage your benefits and payroll online. You can find everything in one place your 401(k), health benefits, stock plans, and more. You can also file a claim, view account balance and summary information, sign up for free direct deposit, and get email notifications, streamlining the entire process. Employees can use a username or their social security number (SSN) to log in. However, the system highly recommends creating a personalized username for added security.

A critical aspect of navigating your benefits is understanding the concept of a "username" as an identifier. You can use this custom identifier instead of your social security number (SSN) for logging in, adding a layer of security to your account. This highlights a modern focus on user security, helping to safeguard your financial data in an increasingly digital environment. The convenience of managing your accounts is coupled with the critical importance of safeguarding your personal information.

Your workplace benefits serve as your single source of information for everything you need to know about your benefit accounts. It also streamlines the process of filing claims, viewing account balances, and summary information, including the convenience of free direct deposit setup and email notifications.

For the sake of employees' well-being, several employers focus on the health of their workforce. Lukes University Health Network prioritizes this, recognizing that a healthy workforce is vital to the success of the organization. This recognition translates into the availability of resources designed to promote healthy living among employees. The focus extends beyond just financial benefits, acknowledging the importance of holistic well-being.

Managing your investments and workplace benefits with Fidelity NetBenefits offers several advantages. It provides a consolidated platform for overseeing your financial future. You can access all your benefit-related information and manage your investments efficiently. This one-stop-shop approach simplifies the process of managing your financial life.

For employees and those seeking online access, the availability of registration is significant. By creating a profile and logging in or registering, users gain access to details of enrolling in benefits and managing their accounts.

One of the frequently discussed topics in financial planning is retirement savings, in order to encourage and simplify retirement savings for employees, the workplace savings plan is designed to include tax benefits, and sometimes an employer match. It aims to make saving and investing for retirement easier.

For team members at BJC, the "Total Rewards" program is another valuable option. It is designed to add value to members lives by meeting needs at work and beyond. It is divided into five distinct areas, which provide comprehensive support and encouragement for overall well-being.

In addition to the various digital platforms and online resources, many companies also offer physical locations. The address for customer services, for instance, may be given as 4853 Galaxy Parkway Suite K Cleveland, Ohio 44128, along with a phone number for direct assistance.

Ultimately, your ability to leverage your employee benefits and make sound financial choices is a key element in building a secure financial future. By understanding the tools and resources available to you, and taking an active role in managing your finances, you are taking a vital step toward a more secure financial future.

- Ximena Model More Latest Updates News You Need To Know

- Mark Packer Net Worth Insights Earnings In 2025 Latest

User Guide MyRPB for Participants NetBenefits Reform Pension Board

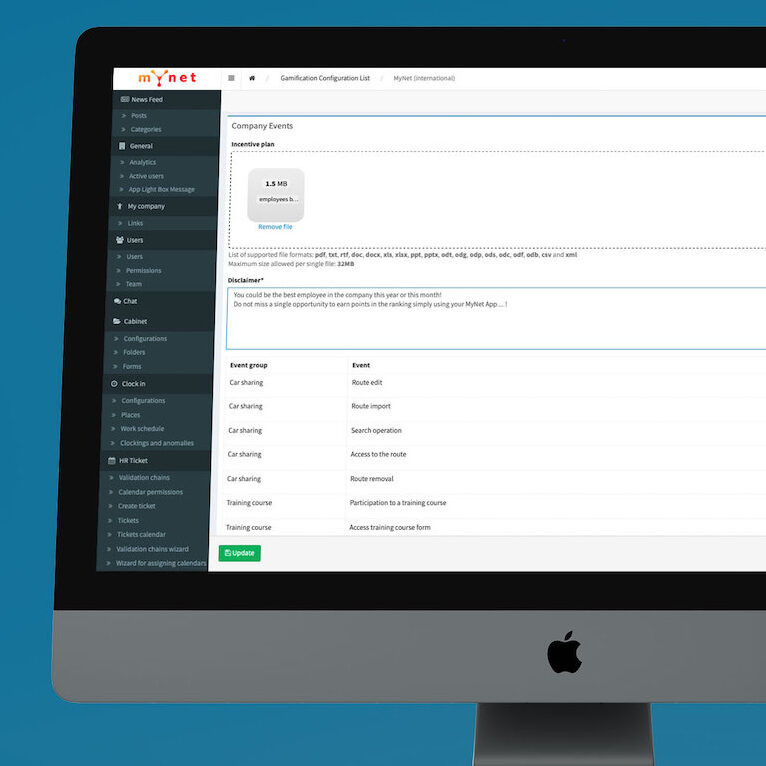

Hr gamification to win additional corporate benefits App MyNet

MyNet diventa Società Benefit YouTube